Key Role-Players

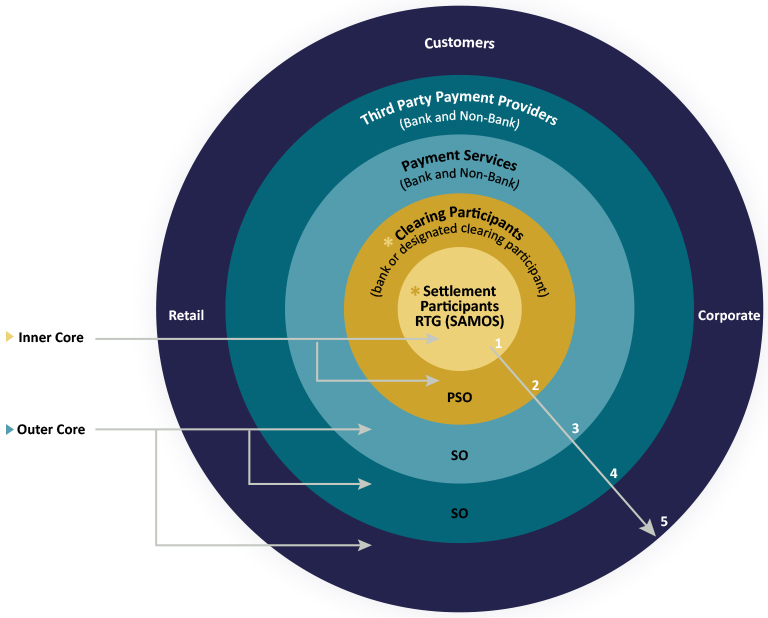

The NPS includes different layers of participants starting with a highly regulated inner core followed by participants who are regulated to an ever decreasing extent. The various layers are demonstrated in the form of an Onion ring diagram as can be seen on the right.

Inner Core

The inner core comprises layers 1 and 2.

Settlement Participants

The first layer consists of settlement participants, which all have settlement accounts with the South African Reserve Bank (SARB). Settlement of payment obligations between these participants is achieved through the South African Multiple Options Settlement (SAMOS) system which is owned and operated by the SARB. At this stage, only South African registered banks can hold settlement accounts. Banks or designated participants who do not have settlement accounts may be sponsored by settlement participants.

Clearing Participants

Clearing participants may be banks or designated clearing system participants (who may be non-banks) who are members of PASA and at least one Payment Clearing House (PCH). Clearing of payment instructions between these participants is achieved through authorised PCH System Operators (PSOs). At present, there are four authorised PSOs: Strate Limited, PayInc, Visa and MasterCard. Settlement of these clearing obligations is achieved either directly if the participant is also a settlement participant, or else through sponsorship.

Outer Core – Providers of Payment Services

The outer core comprises layers 3, 4 and 5.

System Operators (SOs)

The third layer consists of providers of payment services either directly by a clearing participant or by means of a System Operator (SO). A System Operator (SO) is a non-bank and, in terms of SARB Directive 2 of 2007 provides services in relation to payment instructions, i.e. it provides electronic means (including the delivery to and/or receipt of payment instructions) to two or more persons to allow such persons to send or receive payment instructions. SOs should not be confused with PSOs. The latter facilitates clearing. SOs are authorised in terms of the South African Reserve Bank (SARB) Directive 2 of 2007 by PASA, on behalf of the South African Reserve Bank (SARB). A list of authorised SOs may be obtained from PASA upon request. The Criteria for Authorisation as a System Operator is available on PASA’s website.

Third Party Payment Providers (TPPPs)

The fourth layer consists of clearing participants and registered non-bank Third Party Payment Providers (TPPP). There are two types of TPPP, namely Beneficiary Service Providers (BSP) and Payer Service Providers (PSP). A PSP or BSP, in terms of SARB Directive 1 of 2007, accepts money or the proceeds of payment instructions from payers for on-payment to third persons to whom the money is due (Section 7 of the NPS Act refers). A TPPP is typically enabled by a SO, and may hold funds for payment due in its own bank account for a limited period of time. A SO only provides the technology but does not accept the funds into its own bank account for on-payment to another party. All TPPPs have to be registered by a clearing participant. A list of registered TPPPs is available from PASA upon request.

Business Customers and Payment Providers

The fifth layer consists of consumers and business customers of Banks, TPPPs and other providers of payment services. Their entry and participation criteria are set by Banks/TPPPs/SOs, which are aligned with the PCH rules and agreements.

System Operators (SOs)

SOs should not be confused with PSOs. The latter facilitates clearing.

SOs are authorised in terms of the SARB Directive 2 of 2007 by PASA, on behalf of the SARB. A list of authorised SOs may be obtained from PASA upon request. The Criteria for Authorisation as a System Operator is available on PASA’s website.

Third Party Payment Providers (TPPPs)

A TPPP is typically enabled by a SO, and may hold funds for payment due in its own bank account for a limited period of time. A SO only provides the technology but does not accept the funds into its own bank account for on-payment to another party.

All TPPP’s have to be registered by a clearing participant. A list of registered TPPPs is available from PASA upon request.

Business Customers and Payment Providers

The fifth layer consists of consumers and business customers of Banks, TPPPs and other providers of payment services. Their entry and participation criteria are set by Banks/TPPPs/SOs, which are aligned with the PCH rules and agreements.