You are here: PIB

Payments Industry Body

In June 2021 the South African Reserve Bank (SARB) requested PASA to facilitate the co-design of a new Payments Industry Body (PIB) by an inclusive community of payment system stakeholders.

Guidance from the SARB on the purpose of the new PIB is that it must:

– Be in the interest of the National Payment System (NPS)

– Achieve and maintain interoperability

– Assist the SARB and other related regulators in ensuring a safe and efficient NPS

– Support the execution of Vision 2025 and other policy goals

The principles set out in guidance received from the SARB are:

– Pursuit of interoperability

– Collaboration and cooperation

– Representative and inclusive industry structures

– Collective pursuit of broader NPS goals

This industry collaboration resulted in a report that was submitted on 14 November 2022 to the SARB for

consideration.

Download the report here.

The rest of this page contains updates that were made available during the design process. To stay on top of the latest updates on PIB News, please follow the PASA LinkedIn page at

UPDATE 11

The co-creation of the new Payments Industry Body (PIB) for South Africa has taken another important step forward. Following legal opinion that the PIB Design could not be given effect in a Non-Profit Company (NPC), the PIB community was requested to choose whether a new association had to be created for the PIB or if the existing PASA association could be repurposed.

In response to this request for sign-off, 100% of all responding parties supported the re-use of the existing PASA legal entity for the PIB.

The timeline for the implementation of any necessary changes is still dependent on several factors, but in the meantime PASA will continue to provide regular updates to the payments industry and interested parties.

UPDATE 10

On 26 September 2023 the PIB project reached a major milestone: confirmation from the SARB that it has no objection to the PIB Design.

The letter informing PASA of the news states: “The SARB NPSD reaffirms its support for the establishment of the PIB and expects PASA and the PIB community to execute relevant actions to prepare for the establishment of the structure”.

While there are still some detailed design elements which need to be completed, this milestone triggers the start of some of the work required to transition from PASA to the PIB.

UPDATE 9

Defining the plan to transition into the new payments industry body is the current focus of the PIB project that kicked off in June 2021.

The SARB has formed the payment system management body (PSMB) Transition Committee that will engage and consult with stakeholders to facilitate a smooth regulatory transition.

Since the PIB Design Report was submitted on 14 November 2022, work has been ongoing with the SARB towards closing out their “no objection” to the Report, with the SARB having expressed their overall support for the proposed PIB Design. PASA’s executive team has completed an integrated transition plan to map out the transition approach.

While there are still considerable areas of uncertainty, the picture is getting much clearer on the shape of the transition and implementation. As the PIB transition begins to gain traction, the PASA executive team will continue to work closely with the stakeholders to mitigate potential risks associated with the pending CoFI Bill and amendments to the NPS Act.

To ensure the PIB design effort remains collaborative and inclusive, PASA continues to host update and education sessions:

- PIB industry sessions to provide PIB updates and next steps to the entire community

- PIB university sessions to provide a change management overview plus unpack various chapters of the PIB Report for current PASA member representatives

- Ongoing workshops with the non-bank fraternity on how they will engage with the PIB

- PIB townhall sessions to unpack the PIB Design with PASA employees

We welcome your comments, feedback and questions. Please get in touch with us via PIB@pasa.org.za

UPDATE 8

14 November 2022 was a historic day, a celebration of a ground-breaking industry collaboration, and the start of a new era.

Watch and enjoy this video of the PIB Report Celebration and the formal handover of the report to the SARB for consideration.

View the event video on our LinkedIn page: https://www.linkedin.com/feed/update/urn:li:activity:7000716138414264320

UPDATE 7

The Industry Forum meeting on 7 September 2021 was the first of 12 that brought together 259 participating organisations in contributing to the design of a new Payments Industry Body (PIB) as requested from PASA by the South African Reserve Bank (SARB) in June 2021.

This video highlights the substantial amount of work that went into the process.

We are deeply grateful to all participants that co-created a signed off PIB Design that will be used as the basis for the report to be submitted to the SARB.

The sign off process has been truly consultative and transparent on the big issues as well as the smallest concerns raised; everyone was afforded an opportunity to be heard.

PIB Design (all signed-off topics) – 2022-08-16

Well done – and THANK YOU – to everyone who participated; WE DID IT!!!

NEXT STEPS:

- The report for submission to the SARB will now be compiled

- Before the report is submitted to the SARB, the PIB Design participants will be provided an opportunity to review and comment on whether it accurately reflects what was signed off.

UPDATE 6

The process of designing a new Payment Industry Body (PIB) for South Africa commenced in September 2021 and is still ongoing after robust debates and iterations.

To ensure all participants maintain full understanding of the new design implications on their organisations, we would like to share a recap session of this industry training below.

Watch it here: PIB | Industry Training – Recap of PIB Design content

UPDATE 5

SARB Deputy Governor’s case study on transformational challenges

The South African Reserve Bank (SARB) acknowledges PASA’s transition to a PIB, together with the valuable lessons learnt from other industries that would aid this process.

Linked below, SARB Deputy Governor Kuben Naidoo’s presentation covers transformational challenges in an interesting case study from the mining industry, which has impacted the Richards Bay coal terminals, and South Africa’s foreign exchange reserves at large.

The study’s parallels to the payments industry are significantly profound, due to the push for more advancement and the creation of fair access in both industries.

Watch Kuben’s insightful presentation here:

UPDATE 4

Applying a telecommunications industry case study to the PIB

As the payments industry collaborates in the design of a new, more inclusive industry body, our intention is to also develop better perspectives around industry level changes.

In this recording, Professor Herman Singh gives a case study overview from the telecommunications industry, showcasing the need to adapt, change and stay relevant in a competitive and dynamic market.

Watch the interesting case study here:

UPDATE 3

For the new Payments Industry Body (PIB) to succeed, a broad group of stakeholders from different industries and very different businesses have to cooperate and work together.

This requires parties who are for the most part vigorous competitors to collaborate in building out the PIB as a common good platform in the interests of the South African economy; a collaboration that requires significant culture change across the payments industry.

Visit https://youtu.be/45FbMBABTsk to watch.

UPDATE 2

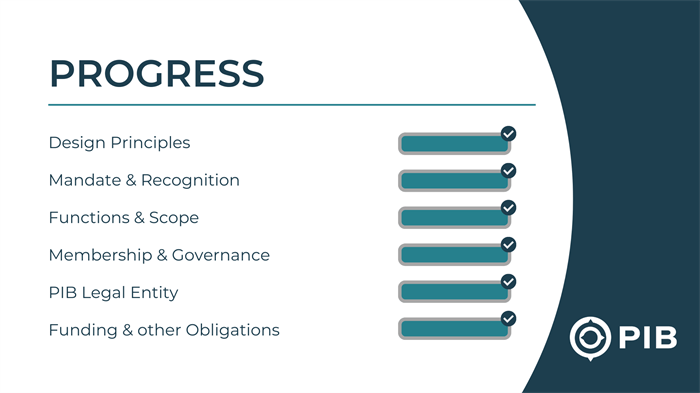

From October 2021 to January 2022 the PIB Design process focused on:

- Explaining mechanisms for obtaining earlier content consultation

- Discussing foundational PIB content

- Introductory payments training for the industry

- Discussions on the PIB Design Principles, Function & Scope, Membership & Governance, Funding, and Mandate.

The way in which the various participant groups engaged with the material was truly impressive, and the feedback was positive and constructive.

The need to make the design process truly inclusive, combined with the impressive engagement received from across the payments industry, encouraged us to engage with all parties who have material comment even after a topic had received majority sign-off. This has proven to be a valuable exercise, with a much-improved outcome, and has been applied to both the Design Principles and the Function & Scope.

After a total of eight industry workshop days and ten educational sessions, the PIB Design Principles have been signed off with very strong support and the remaining topics are currently in the sign-off process.

Given the amount of information and content which needed to be shared, understood, and absorbed by the Industry Forum before sign-off can be obtained, the original timeline for the PIB design phase has been extended to Q2 2022.

MAIN HIGHLIGHTS

Received sign-off of the Design Principles and developed a common language and understanding to debate PIB design intricacies.

Download the PIB Design Principles at PIB Design Principles.

NEXT STEPS

- Once sign-off on all topics has been received, the project focus will shift from developing design content to drafting the PIB Design Report. Drafting is planned to commence in February 2022 and for industry forum circulation early April. A Design phase wrap-up workshop is planned for later in April.

- The report will then be submitted to the SARB.

- Once the PIB Design Proposal for the SARB has been submitted, we will start working on the complex transition plan.

UPDATE 1

There are two main project structures currently active in the PIB project:

The Design Team

The Design Team will not be designing the PIB, but rather ensuring that the process to design the PIB is credible, that the content is balanced, fair and that any issues between payments industry stakeholder (“onion ring”) cores in the Sign-Off process are resolved. Members of the Design Team do not represent specific sectors but are selected to serve the process as a whole.

The mandate of the Design Team is clearly articulated across three dimensions:

- Process: overseeing that the process run by PASA and the project team is fair, transparent and credible.

- Content: ensuring that the content presented to the industry forum for consultation is credible, balanced and unbiased.

- Problem resolution: assisting if the sign-off process cannot be agreed across different cores of the payments industry stakeholder “onion ring”.

Selected on the core principles of credibility, expertise and experience and to provide diverse perspectives, the Design Team consists of:

1. Bradley Wattrus*

2. Busi Radebe

3. Dirk Ehlers

4. Gavin Reubenson

5. Gerhard Oosthuizen

6. Ghita Erling

7. Hennie Ferreira

8. Herman Singh

9. Jacque du Toit

10. Jan Pilbauer

11. Kagisho Dichabe

12. Karen Nadasen

13. Rufaida Banoobhai

14. Sydney Gericke*

15. Wynand Malan

*Have stepped away from the PIB Design Team membership and we appreciate their valuable input.

The Industry Forum

The Industry Forum consists of all stakeholders who make up the broader payments community. The Industry Forum is consulted on all PIB design elements, and their feedback is solicited and then integrated into final proposals for formal sign off through the agreed sign-off process. This process is designed so that natural groupings (inner, middle or outer core participants) sign-off independently based on sufficient consensus between all the participants in any of the cores. Should issues arise between cores or groupings, the Design Team will facilitate resolution.

In preparation for the first Industry Forum meeting, we requested the invitees to complete a survey on what will make the PIB design process successful and which functional elements of possible PIB responsibilities should be considered. The survey showed strong support for the importance of an inclusive Payments Industry Body and emphasised areas of concern and interest.

269 separate entities were invited to attend the first Industry Forum meeting that was held on 7 September 2021. The agenda included:

– Results of the PIB Survey

– The role of the Industry Forum

– The role of the Design Team

– Members of the Design Team and how they were selected

– The sign-off process

MAIN HIGHLIGHT: 97% of participants formally accepted the structures and processes proposed for the PIB design effort.

PARTICIPANT FEEDBACK SELECTION:

– Phenomenal effort putting this together

– Leaders are knowledgeable and open-minded

– Appreciate the anonymous voting

– Good interaction and a good start to more collaboration

– Broad engagement, good facilitators, well structured